Why do online card payments fail?

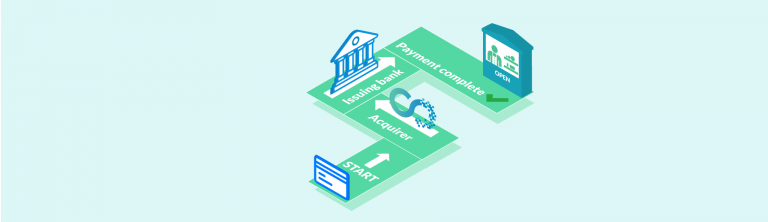

Usually online transactions are processed successfully, but sometimes payments can fail. Payment processing flow includes multiple role players and each can be responsible for a transaction failure. Online card transaction failures are usually beyond merchant control. However, there are certain actions a merchant can take in order to complete a transaction or prevent transaction failures ...